Bad news—starting in September, you’ll be paying higher taxes in several categories.

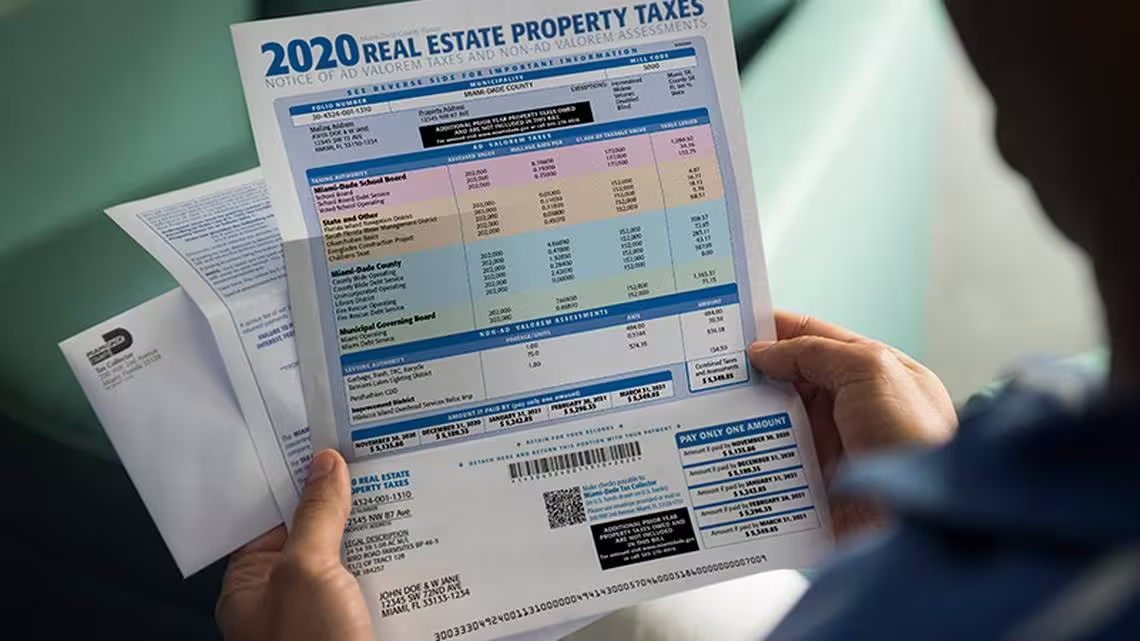

Beginning in September 2024, Miami-Dade County will see a significant increase in property taxes, according to Pedro García, the county’s property appraiser. This increase has caused concern among residents who already feel the pressure of rising financial obligations.

What’s Driving This Increase? The primary factor behind this hike is the appreciation in property values, which has risen by more than 6% over the past year. Although the tax rate hasn’t changed, the increase in assessed values means that property owners will have to pay more.

Let’s do the math. For example, a home valued at $500,000 in 2023 with a 2% tax rate will have an annual tax of $10,000. However, a 20% increase in assessment to $600,000 in 2024 would result in a new payment of $12,000 for the same property. That’s quite significant.

Differences Based on Property Type Pedro García explained that homes with a homestead exemption—a benefit that protects primary residence owners—will see a maximum increase of 3%.

On the other hand, investment properties, such as rental houses or apartments, could face increases of up to 10%. This cap reflects the current real estate market conditions in Florida, where prices continue to rise.

Additionally, condominium owners are dealing with higher insurance and maintenance fees. Tenants, already burdened by rising rents, often absorb these additional costs. Residents have expressed concern, stating that the situation is becoming unsustainable.

Impacts and recommendations Miami-Dade County’s budget has grown significantly in recent years, surpassing $12 billion. A substantial portion of this budget relies on property taxes. Given this reality, Pedro García suggested that greater control over public spending is necessary to prevent the burden of these increases from continuing to fall on property owners.

García also urged residents to participate in county commission meetings to voice their concerns and advocate for fairer solutions.

The Homestead Exemption: How It Works and Who Benefits The Homestead Exemption in Florida is a tax benefit that reduces the assessed value of a homeowner’s primary residence, thereby lowering their property taxes. This exemption can reduce the assessed value by up to $50,000 and limits the annual increase in assessed value to 3% or the rate of inflation, whichever is lower.